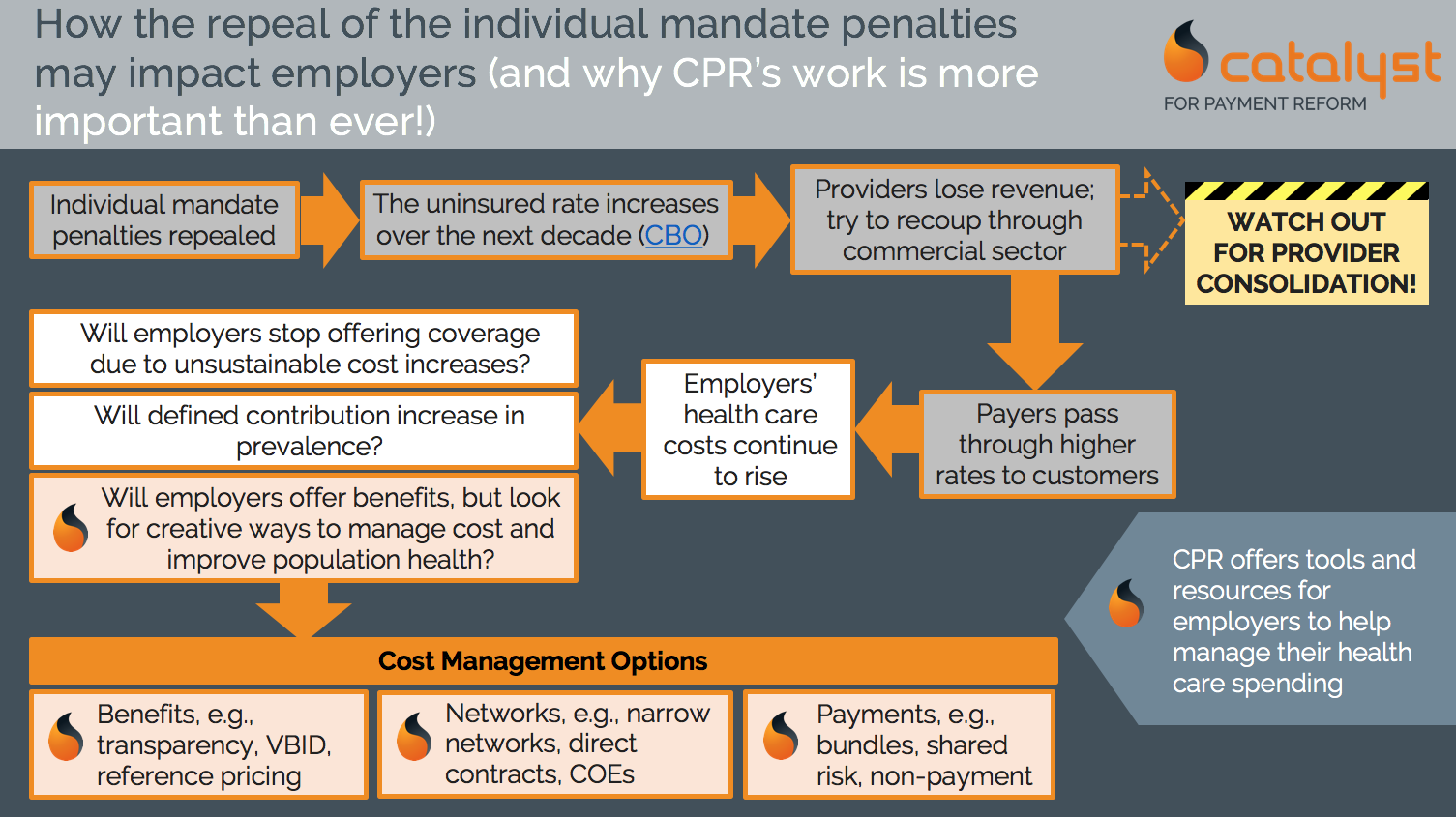

With the passage into law of the Tax Cuts and Jobs Act on December 22, 2017, this bill is now in the rear-view mirror. While the tax impact on corporations and individuals is substantial, CPR can’t help but wonder what the impact of repealing the penalties associated with the health insurance coverage mandate will be on employers and other health care purchasers. What we do know is that the Congressional Budget Office anticipates 13 million more American will be uninsured by 2027. Take a look at our infographic on the potential impact the increased number of uninsured could have on employers…

While we don’t have a magical crystal ball readily available (things would be so much more predictable with one at our disposal!), what we project is that employers and others will continue to focus on cost management options, tweaking benefits, selective provider networks, and continuing to shift provider payments from fee-for-service to value-oriented payments. These options allow employers to control their own destiny and ensure that benefits remain a strong value proposition for their populations and potential talent. Also, that wave of consolidation in the health care industry we saw at the end of 2017…we think it will persist as a result of continued financial pressures on provider organizations. CPR will continue to seek innovative ways to support health care purchasers in this time of transition.

Did we get the infographic right? What do you think? Send us a note at info@catalyze.org and let us know your thoughts!